Health insurance law is complicated, our job is to make it easy for you!

If you live in Wisconsin and would like no-cost help applying for an ACA plan, please contact us for help.

For further commentary on why prices keep increasing for consumers, check out our blog!

Affordable Care Act and Full Medical Insurance

|

|

What is the Affordable Care Act? ACA, or “Obamacare”, is a federal law that protects consumers by setting up rules for health insurance and provides a marketplace for people without other access to insurance (such as employer based or Medicare) to sign up for coverage. The ACA also requires American citizens to have qualified health insurance. Qualified plans are ones that meet the requirements for minimum essential coverage or met the exception for grandfathered plans. Medicare, Medicaid, ACA plans, VA coverage, and most employer based plans count as qualified health insurance.

There are tax penalties for people who choose not to buy insurance but have the means to do so. For people with very low income, there are exemptions to the penalties. There are also exemptions for certain religious groups, and for people who do not have access to the law’s definition of affordable coverage. |

What do I need to know?

I've heard bad things about the ACA. Why do you like it?

If I could only choose one thing to point out it is this: The ACA provides guaranteed access to insurance. This did not exist before the ACA. The ACA did away with pre-existing condition limitations for individuals. Before ACA, insurance companies could deny coverage to people with medical conditions--even insignificant medical conditions like acne. Worse, when people already had the coverage and had been paying for it, sometimes insurance companies denied claims based on pre-existing conditions. It was difficult for pregnant women to get covered (see Examples of ACA in Action for a true story about this). This website and company isn't about debating the merits or repeal of the law, but rather about making the law work for you. If you lose your job, or if you become disabled and can no longer work, you have options.

If I could only choose one thing to point out it is this: The ACA provides guaranteed access to insurance. This did not exist before the ACA. The ACA did away with pre-existing condition limitations for individuals. Before ACA, insurance companies could deny coverage to people with medical conditions--even insignificant medical conditions like acne. Worse, when people already had the coverage and had been paying for it, sometimes insurance companies denied claims based on pre-existing conditions. It was difficult for pregnant women to get covered (see Examples of ACA in Action for a true story about this). This website and company isn't about debating the merits or repeal of the law, but rather about making the law work for you. If you lose your job, or if you become disabled and can no longer work, you have options.

|

|

Who may be able to get an ACA plan? American citizens and legal permanent residents who do not otherwise have access to employer-based insurance, Medicare, or Medicaid. People who do not have access to other insurance (like an employer-based plan, Medicare, Medicaid, Tricare, etc) may qualify for a tax credit to help pay for coverage.

When can people sign up? During the Open Enrollment Period, which is held every year from November 1st to December 15th for January 1st coverage. Outside of Open Enrollment, those with Special Enrollment Periods for qualifying life events such as loss of a job, marriage, or birth of a child can sign up. |

What's in it for me if I have insurance through my employer? The ACA mandates that insurance plans offer minimum essential coverage. Some plans have been grandfathered in, which means the plan has not changed since the law went into effect, and some of the benefits may be different or less than ACA requirements. Except for those grandfathered plans, most most employer based plans now provide minimum essential coverage, free preventative care, and cannot discriminate against people for pre-existing conditions. The law also mandates that new employees cannot be forced to wait more than 60 days for coverage to start, and parents can keep adult children on their plan up to age 26. The ACA also mandates mental health parity, which means insurance companies must cover mental health care at the same rate as a primary care provider. Before the ACA, many companies refused to cover mental health care.

How does ACA protect me if I lose my employer-based coverage? If you lose your job (or your spouse who carries insurance loses their job) you may be eligible to sign up for an ACA plan to fill in the gap between jobs or if you experience extended unemployment. Before ACA, people who lost their jobs either had to take expensive COBRA coverage or risk their financial security and health by going without health insurance coverage. Since almost all adults have some sort of pre-existing condition (acne, cancer, previous pregnancy - yes! having a baby was often considered a pre-existing condition!), very few people could get full coverage when buying an individual plan. Now, through the ACA, when you lose employment or are between jobs, you likely qualify for an ACA plan that won't deny you for medical conditions.

|

You may be eligible for a 60-day Special Enrollment Period to sign up if:

|

You may be eligible to sign up during the Open Enrollment Period (November 1st to December 15th) to sign up for next year coverage if:

- You are uninsured

- You do not otherwise have access to health insurance through an employer, Medicare, Medicaid, or TRICARE

- You took COBRA when you left a job but wish to switch to an ACA plan

- You get Social Security Disability or early retirement benefits and are not yet eligible for Medicare

- You retired early and get a pension or retirement savings distribution but no health insurance and failed to sign up within 60 days of losing coverage (or you took COBRA)

- You lost coverage sometime during the year but failed to sign up during your Special Enrollment Period

- You have access to coverage through an employer/spouse's employer but would prefer to pay full price for an ACA plan

- Your employer/spouse's employer based coverage does not meet the law's definition of affordability

You might not qualify for a tax credit if:

- You have access to employer-based insurance through your or your spouse's job (you may still be able to pay full price for a marketplace plan during open enrollment)

- You are eligible for Medicare

- You have Medicaid coverage

- You have a TRICARE plan (most plans)

- Your spouse has employer-based insurance but the employer doesn't offer coverage to you (you may qualify for an exemption to the tax penalty if this is the case, and while you might not get a tax credit, you may still be able to buy a marketplace plan at full price during open enrollment)

- You are claimed as a dependent by your parent(s)

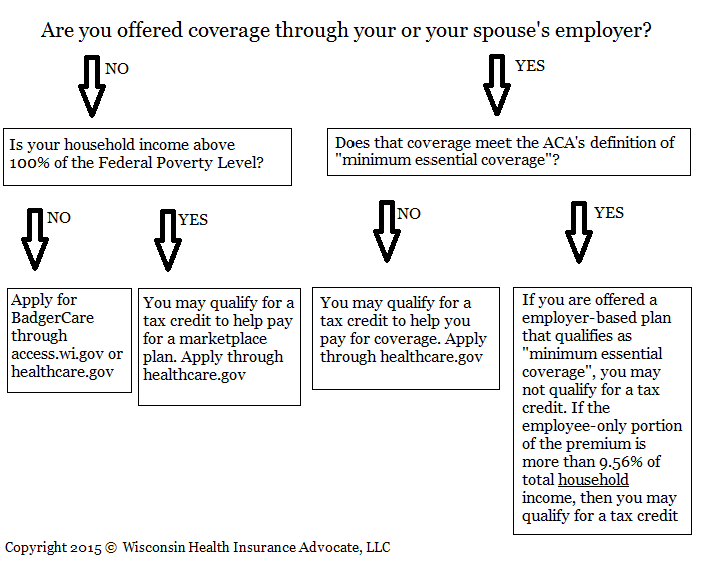

Not sure if you're eligible for an ACA plan? Read the chart below for guidance.

|

|

Special Enrollment Periods Video

Check out the video for more information on who qualifies for a Special Enrollment Period and when. |

Examples of ACA in Action

Mary: Mother-to-be on bed-rest

Several years ago, before the ACA was fully implemented, I worked with a pregnant woman who has just lost her job and thus the insurance she carried for her whole family. Mary's doctor ordered bed-rest and told her that if she found another job and continued to work it would risk her baby's life. She was not eligible for Social Security disability because her condition was not expected to last 12 months or more. Mary's husband's employer did not offer insurance. Their family was above the income limit for Medicaid, but their monthly income was less than the COBRA premium (even before expenses like food or rent).

Mary had applied to several individual insurers but had been rejected by most, and the insurance she was approved for was outrageously expensive and excluded essential benefits. Her family was facing bankruptcy and homelessness. They even considered divorce just so she and the unborn baby could get insurance. Mary's husband was desperately searching for new work with insurance, but finding a good job that offers insurance is rarely a quick thing. This is a problem solved by ACA. If this family encountered this situation today, they would be eligible to buy an ACA plan during a special enrollment period brought on by the loss of her other insurance.

Prior to ACA, when people changed jobs, went back to school, worked part time, or were laid off and looking for work, it was very tough to get insurance coverage. COBRA coverage was available to some, but can be very expensive.

Before ACA, it was very difficult for self-employed people to get affordable insurance. Small businesses often paid high premiums for sub-par insurance coverage due to pre-existing conditions of employees and small risk groups. The following examples are all true stories, but identifiable information has been changed for confidentiality.

Several years ago, before the ACA was fully implemented, I worked with a pregnant woman who has just lost her job and thus the insurance she carried for her whole family. Mary's doctor ordered bed-rest and told her that if she found another job and continued to work it would risk her baby's life. She was not eligible for Social Security disability because her condition was not expected to last 12 months or more. Mary's husband's employer did not offer insurance. Their family was above the income limit for Medicaid, but their monthly income was less than the COBRA premium (even before expenses like food or rent).

Mary had applied to several individual insurers but had been rejected by most, and the insurance she was approved for was outrageously expensive and excluded essential benefits. Her family was facing bankruptcy and homelessness. They even considered divorce just so she and the unborn baby could get insurance. Mary's husband was desperately searching for new work with insurance, but finding a good job that offers insurance is rarely a quick thing. This is a problem solved by ACA. If this family encountered this situation today, they would be eligible to buy an ACA plan during a special enrollment period brought on by the loss of her other insurance.

Prior to ACA, when people changed jobs, went back to school, worked part time, or were laid off and looking for work, it was very tough to get insurance coverage. COBRA coverage was available to some, but can be very expensive.

Before ACA, it was very difficult for self-employed people to get affordable insurance. Small businesses often paid high premiums for sub-par insurance coverage due to pre-existing conditions of employees and small risk groups. The following examples are all true stories, but identifiable information has been changed for confidentiality.

Mark and Debra: When the spouse who carries insurance loses a job

I got a call from Mark who had to leave his job due to a disability. His wife and two children were on his employer's insurance plan. Through the ACA, this family of four was able to get insurance for significantly less than COBRA thanks to the ACA's cost sharing reductions based on income.

I got a call from Mark who had to leave his job due to a disability. His wife and two children were on his employer's insurance plan. Through the ACA, this family of four was able to get insurance for significantly less than COBRA thanks to the ACA's cost sharing reductions based on income.

Robert and Laura: When the spouse who carries insurance retires

Robert turned 65 this year and started Medicare. Laura works too but her job doesn't offer insurance. Robert told me he is ready to retire, but his wife, Laura was several years younger than Robert and would be without insurance if Robert retired. The ACA helps solves this problem. Now, Robert can retire and take Medicare, while Laura can purchase a plan through the ACA on healthcare.gov or her state’s exchange.

It used to be that when one member of a couple carried the insurance through a job it was difficult to leave that job or retire is their spouse was younger or didn't have access to their own employment based insurance.

Robert turned 65 this year and started Medicare. Laura works too but her job doesn't offer insurance. Robert told me he is ready to retire, but his wife, Laura was several years younger than Robert and would be without insurance if Robert retired. The ACA helps solves this problem. Now, Robert can retire and take Medicare, while Laura can purchase a plan through the ACA on healthcare.gov or her state’s exchange.

It used to be that when one member of a couple carried the insurance through a job it was difficult to leave that job or retire is their spouse was younger or didn't have access to their own employment based insurance.

Geoffry: Steel worker who became disabled on the job

A man named Geoff called me for help because he was losing his employer-based insurance after nearly two years of worker's compensation for a back injury he sustained at work. His employer was ending his coverage suddenly mid-year, and he needed an insurance option. Luckily, Geoff could buy an ACA plan for himself and his wife, with an advanced premium tax credit from the marketplace. Geoff's ACA plan cost less than half of what he would otherwise have to pay for COBRA.

A man named Geoff called me for help because he was losing his employer-based insurance after nearly two years of worker's compensation for a back injury he sustained at work. His employer was ending his coverage suddenly mid-year, and he needed an insurance option. Luckily, Geoff could buy an ACA plan for himself and his wife, with an advanced premium tax credit from the marketplace. Geoff's ACA plan cost less than half of what he would otherwise have to pay for COBRA.

Adult children can stay on their parent's job-based insurance up to age 26

Now, throughout the country adult children can stay on their parent's job-based insurance up to age 26. We know that many college graduates are looking for work or have part time jobs that don't offer health insurance. Now, these people can keep insurance through their parents up to age 26.

Now, throughout the country adult children can stay on their parent's job-based insurance up to age 26. We know that many college graduates are looking for work or have part time jobs that don't offer health insurance. Now, these people can keep insurance through their parents up to age 26.

For the disabled waiting for Medicare

People who have been determined disabled by the Social Security Administration face a two-year (2) wait period for Medicare to begin. Some people who have been determined disabled receive SSI payments (for an individual, that's only $816.78 a month!) because they have little or no work record, such as someone born with a severe disability, and they receive full-benefit Medicaid. But people who develop disabilities later in life receive SSDI payments based on their work record and often that income is too high to qualify for SSI Medicaid. Before the ACA, disabled people often had no access to insurance.

Prior to ACA, insurance companies could use pre-existing conditions as reasons to deny insurance or limit benefits, so most disabled people could not buy individual insurance plans or if they were approved for a plan it was often outrageously expensive and didn't cover their current conditions. For people with disabilities, one of the only ways they could access insurance is if they were married and their spouse had access to employer-based insurance. Now, under ACA, people with disabilities waiting for Medicare to begin can buy an ACA policy and many qualify for help paying for it.

People who have been determined disabled by the Social Security Administration face a two-year (2) wait period for Medicare to begin. Some people who have been determined disabled receive SSI payments (for an individual, that's only $816.78 a month!) because they have little or no work record, such as someone born with a severe disability, and they receive full-benefit Medicaid. But people who develop disabilities later in life receive SSDI payments based on their work record and often that income is too high to qualify for SSI Medicaid. Before the ACA, disabled people often had no access to insurance.

Prior to ACA, insurance companies could use pre-existing conditions as reasons to deny insurance or limit benefits, so most disabled people could not buy individual insurance plans or if they were approved for a plan it was often outrageously expensive and didn't cover their current conditions. For people with disabilities, one of the only ways they could access insurance is if they were married and their spouse had access to employer-based insurance. Now, under ACA, people with disabilities waiting for Medicare to begin can buy an ACA policy and many qualify for help paying for it.