BREAKING NEWS |

Due to the Federal Health Emergency, Medicaid reviews have been suspended.

|

Need practical help with BadgerCare/Medicaid such as finding a doctor or HMO? Call the HMO Enrollment Specialist at 1-800-291-2002. They can also help you choose an HMO if you're not already enrolled. They will provide you with the phone number to call your HMO to find a doctor. If you need a Forward Card (T19/Medicaid/BadgerCare), call the Department of Health Services at 1-800-362-3002. If you need to apply for Medicaid, find your local agency here: contact your local agency.

What is Medicaid?

You might hear Medicaid referred to as "Title 19" or "T19" or sometimes simply "medical assistance". Medicaid is an umbrella term under which a variety of subprograms exist. Title 19 of the Social Security Act established the Medicaid program. Medicaid is primarily intended to provide medical assistance to low income elderly people, people with disabilities including blindness, and children. While Medicaid is mostly funded by the federal government, states are in charge of administering the programs and can make certain modifications. Thus, Medicaid is different in every state.

Medicaid eligibility is always based on income ("financial eligibility"). Many programs also consider assets or "resources" in determining financial eligibility. In addition to meeting the income and asset guidelines, a person must also fall into a Medicaid category to qualify. In Wisconsin, there are many different kinds of Medicaid programs, including a program called BadgerCare for people under 100% of the Federal Poverty Level (FPL), children and pregnant women under 300% FPL, and children in foster care, and a different set of programs for the Elderly, Blind, and Disabled called EBD Medicaid programs. There are also partial benefit programs for people on Medicare who have low income, called Medicare Savings Programs. Please contact your local agency for more detailed information on children's benefits.

As part of the Affordable Care Act, Wisconsin extended BadgerCare to adults between the ages of 19 and 64 whose income is at or below 100% FPL. Wisconsin also reduced the eligibility for BadgerCare for parents and caretakers from 300% FPL to 100% FPL. BadgerCare for children and pregnant women stayed the same at 300% FPL. Wisconsin still has the option to expand BadgerCare to 133% FPL for adults, but has declined to do so. The Affordable Care Act did not change eligibility for Medicaid programs for the elderly, blind, and disabled. Here is a chart from Judicare WI for those FPL numbers.

Medicaid eligibility is always based on income ("financial eligibility"). Many programs also consider assets or "resources" in determining financial eligibility. In addition to meeting the income and asset guidelines, a person must also fall into a Medicaid category to qualify. In Wisconsin, there are many different kinds of Medicaid programs, including a program called BadgerCare for people under 100% of the Federal Poverty Level (FPL), children and pregnant women under 300% FPL, and children in foster care, and a different set of programs for the Elderly, Blind, and Disabled called EBD Medicaid programs. There are also partial benefit programs for people on Medicare who have low income, called Medicare Savings Programs. Please contact your local agency for more detailed information on children's benefits.

As part of the Affordable Care Act, Wisconsin extended BadgerCare to adults between the ages of 19 and 64 whose income is at or below 100% FPL. Wisconsin also reduced the eligibility for BadgerCare for parents and caretakers from 300% FPL to 100% FPL. BadgerCare for children and pregnant women stayed the same at 300% FPL. Wisconsin still has the option to expand BadgerCare to 133% FPL for adults, but has declined to do so. The Affordable Care Act did not change eligibility for Medicaid programs for the elderly, blind, and disabled. Here is a chart from Judicare WI for those FPL numbers.

|

Fraud Alert! There are never any fees to apply for Medicaid in Wisconsin except for the SeniorCare prescription drug program ($30 per person), but that fee is paid to the State of Wisconsin never to a third party or agent. If you encounter someone who tries to charge you a fee to apply, we recommend you promptly report this activity to the fraud unit with the Department of Health Services.

Brokers/Agents should refer you to your local consortium rather than charging a fee to help you apply: contact your local agency. |

|

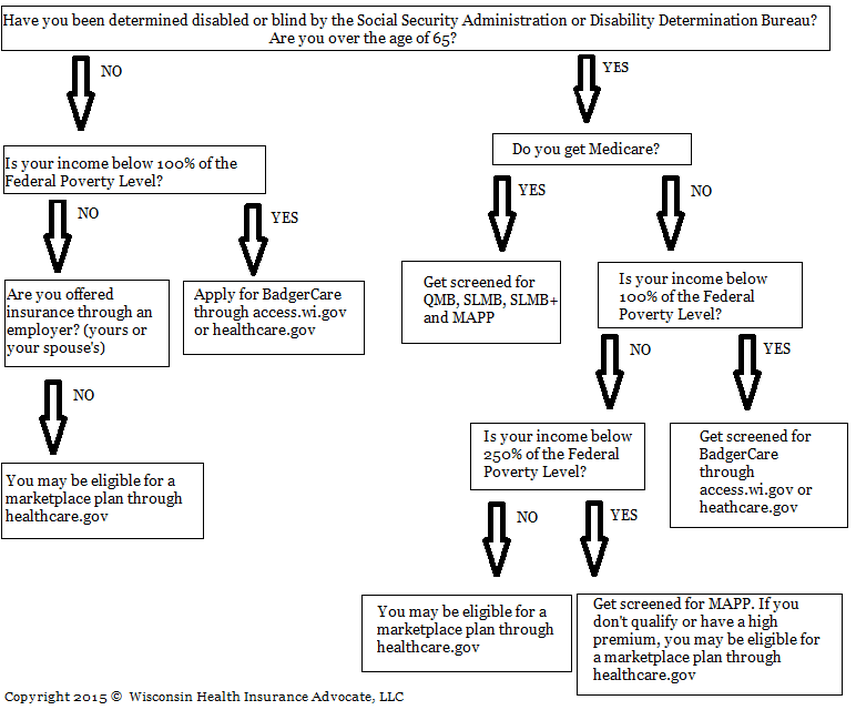

Are you eligible for Medicaid? Guide to Wisconsin Medicaid Eligibility (Adults only)

What is BadgerCare? (For Adults)

|

BadgerCare is a Medicaid program in Wisconsin for adults ages 19-64 with income at or below 100% FPL and for children and pregnant women at or below 300% FPL who do not otherwise have access to insurance.

Badgercare has small co-pays for services depending on income, typically $1-3 per service or prescription. Childless adults who have Medicare do not qualify for BadgerCare, even if their income is at or below 100% FPL (See MAPP and QMB below for more Medicaid options for Medicare beneficiaries). BadgerCare is a full benefit Medicaid program, which means it covers most medically necessary services. There are some limitations and requirements for prior authorization. For example, there is a limit on the number of visits for physical therapy services every year. Most prescription drugs are covered. Most people on BadgerCare must get their services through an HMO, and plans vary by county. |

There are currently no asset/resource limits for the BadgerCare program, only income is considered in determining financial eligibility.

A person can apply for BadgerCare either by calling their local Medicaid agency, or completing an application online through www.access.wi.gov or www.healthcare.gov. |

What is MAPP?

|

|

The Medical Assistance Purchase Plan (MAPP) is a Medicaid program for adults with disabilities who are also working or would like to work (read the work requirement information before getting too scared, it's quite simple!). "Disability" means an official determination from either the Social Security Administration or the Disability Determination Bureau.

|

The work requirement is small, just one (1) hour per month of work for something of value in return. Most people can meet the work requirement with a friend, family member, or neighbor. For example, watching children for a family member in exchange for a home-cooked meal, or cooking a meal in exchange for help mowing the lawn may meet the work requirement. The work cannot be done for a spouse or minor children. The "employer" needs to write a letter to the Medicaid agency explaining what work is done, how often, and what is given in return. The letter can be hand written. MAPP is full benefit Medicaid, including dental and home health care coverage. MAPP has a three (3) month back-dating option, as long as the applicant was doing the work during those months and can provide a letter verifying this.

The MAPP income limits are higher than most Medicaid programs, going up to 250% of the Federal Poverty Level. Here is a handy chart from Judicare WI that will show you the income numbers.

If you do get MAPP with a premium and you don't plan to pay the premium, it is very important to call the Medicaid agency before coverage starts. Otherwise, you may be put into a 12-month restrictive re-enrollment period. Find your Wisconsin Medicaid agency.

The MAPP income limits are higher than most Medicaid programs, going up to 250% of the Federal Poverty Level. Here is a handy chart from Judicare WI that will show you the income numbers.

If you do get MAPP with a premium and you don't plan to pay the premium, it is very important to call the Medicaid agency before coverage starts. Otherwise, you may be put into a 12-month restrictive re-enrollment period. Find your Wisconsin Medicaid agency.

What are QMB, SLMB, and SLMB+?

Medicare Savings Programs

|

|

The Medicare Savings Programs are partial benefit Medicaid programs for Medicare beneficiaries, run by the State of Wisconsin. These programs exist in most states, and the State's Department of Health Services determines eligibility. In Wisconsin, apply through your local Medicaid agency or on access.wi.gov.

QMB Qualified Medicare Beneficiary Income limit*: $1132.50/individual, $1525.83/couple Asset limit**: $8400/individual, $12600/couple

|

SLMB Specified Low-Income Medicare Beneficiary

Income limit*: $1359/individual, $1831/couple

Asset limit**: $8400/individual, $12600/couple

SLMB+/QI Qualified Individual Program

Income limit*: $1528.88/individual, $2059.87/couple

Asset limit**: $8400/individual, $12600/couple

*Income limits: There is a $20 disregard on total gross income. Be sure to add back in any Part B and/or Part D premiums that are automatically deducted from Social Security. Earned income from a job is counted differently: take the total gross earned income, subtract $65 and then divide in half. Then, add in gross Social Security income, and finally subtract $20--this is the total counted income when a person has income from work.

**Asset limit: Assets, or "resources" include bank accounts, retirement accounts, stocks, bonds, CDs, cash, more than one (1) vehicle, property other than the home you live in, burial resources over $1,500, and the cash value of life insurance policies. Contact your local Medicaid agency for more detailed information and eligibility determinations.

You can see Medicare's summary of the Medicare Savings Programs here.

Income limit*: $1359/individual, $1831/couple

Asset limit**: $8400/individual, $12600/couple

- Pays Medicare Part B premium ($164 for 2023)

- Includes Low-Income Subsidy (LIS) for prescription drug coverage

- Can be backdated up to 3 months

SLMB+/QI Qualified Individual Program

Income limit*: $1528.88/individual, $2059.87/couple

Asset limit**: $8400/individual, $12600/couple

- Pays Medicare Part B premium ($164 for 2023)

- Includes Low-Income Subsidy (LIS) for prescription drug coverage

- Can be backdated up to 3 months

- Cannot be combined with any other Medicaid program (such as MAPP or SeniorCare)

*Income limits: There is a $20 disregard on total gross income. Be sure to add back in any Part B and/or Part D premiums that are automatically deducted from Social Security. Earned income from a job is counted differently: take the total gross earned income, subtract $65 and then divide in half. Then, add in gross Social Security income, and finally subtract $20--this is the total counted income when a person has income from work.

**Asset limit: Assets, or "resources" include bank accounts, retirement accounts, stocks, bonds, CDs, cash, more than one (1) vehicle, property other than the home you live in, burial resources over $1,500, and the cash value of life insurance policies. Contact your local Medicaid agency for more detailed information and eligibility determinations.

You can see Medicare's summary of the Medicare Savings Programs here.

What is SeniorCare?

SeniorCare is a prescription drug program for Wisconsin residents over the age of 65.

There is a yearly application fee of $30 per person and no premiums. Benefits depend on income, people with higher incomes must meet yearly deductibles before benefits kick in.

Enrolling in SeniorCare can also give you a once-per-year switch opportunity to change your Medicare plan (except for Supplement plans).

SeniorCare can work with a Medicare Part D plan, and may be great for people with high drug costs especially when they are subject to the Part D donut hole. SeniorCare counts as credible prescription drug coverage.

Click here for more information from the State of Wisconsin.

There is a yearly application fee of $30 per person and no premiums. Benefits depend on income, people with higher incomes must meet yearly deductibles before benefits kick in.

Enrolling in SeniorCare can also give you a once-per-year switch opportunity to change your Medicare plan (except for Supplement plans).

SeniorCare can work with a Medicare Part D plan, and may be great for people with high drug costs especially when they are subject to the Part D donut hole. SeniorCare counts as credible prescription drug coverage.

Click here for more information from the State of Wisconsin.

What is SSI?SSI (Supplemental Security Income) is a federal program for people who are elderly, blind, or disabled and have little to no income and resources. The program includes very modest monthly payments from Social Security and small supplemental payment from the state. Some disabled children receive SSI when their parents/guardians have little or no income and resources. Only a person who qualifies as disabled/blind by Social Security Administration or someone over the age of 65 qualify for the program. SSI includes full Medicaid through the state. As with all federal and state programs, only US citizens and legal permanent residents (over 5 years) qualify for the program if they meet the disability or age and income/resources criteria.

People on SSI who also have Medicare can qualify for some great programs. Contact us for more information. |

|